Public Outrage Grows as KUSCCO CEO George Ototo Remains Silent on Corruption Allegations

-

Breaking: New Evidence Emerges in Corruption Cases Against KUSCCO CEO George Ototo

-

Uncovering the Web of Corruption: KUSCCO CEO George Ototo’s Involvement

-

The Real Cost of Corruption: How KUSCCO CEO George Ototo’s Actions Impacted Thousands

-

KUSCCO CEO George Ototo: The Face of Corruption in the Corporate World

KUSCCO CEO George Ototo building a mall in Langata with a 60 million shilling loan not backed by any Kuscco shares or savings.

The Sacco Societies Regulatory Authority (SASRA) has started an audit on the Kenya Union of Savings and Credit Cooperative Society (Kuscco) following allegations of illegal deposit-taking business.

The auditors are shocked by the big gap in the declared Sacco deposits and what is actually held by Kuscco, which is reportedly running into billions of shillings.

According to sources, Kuscco CEO George Ototo is running around in town with wads of money to take care of complaining Sacco officials who are not able to access their funds. He is also holding regional forums and openly lying that the funds are invested in Treasury bonds, which can’t be supported by Kuscco’s audited financial statements.

The audit revealed that huge funds have been diverted to other projects, such as housing and mutual insurance, without the consent of the Sacco members. The CEO is building a mall in Langata with a 60 million shilling loan not backed by any Kuscco shares or savings.

The Insurance Regulatory Authority (IRA) is being challenged on how the licence was issued to Kuscco Mutual Assurance, a subsidiary of Kuscco, without proper due diligence.

The integrity of the board of directors of Kuscco is also in question, as they have covered up the CEO’s misdeeds and also borrowed huge unsecured loans from the Sacco. They have failed to exercise their fiduciary duty and protect the interests of the Sacco members.

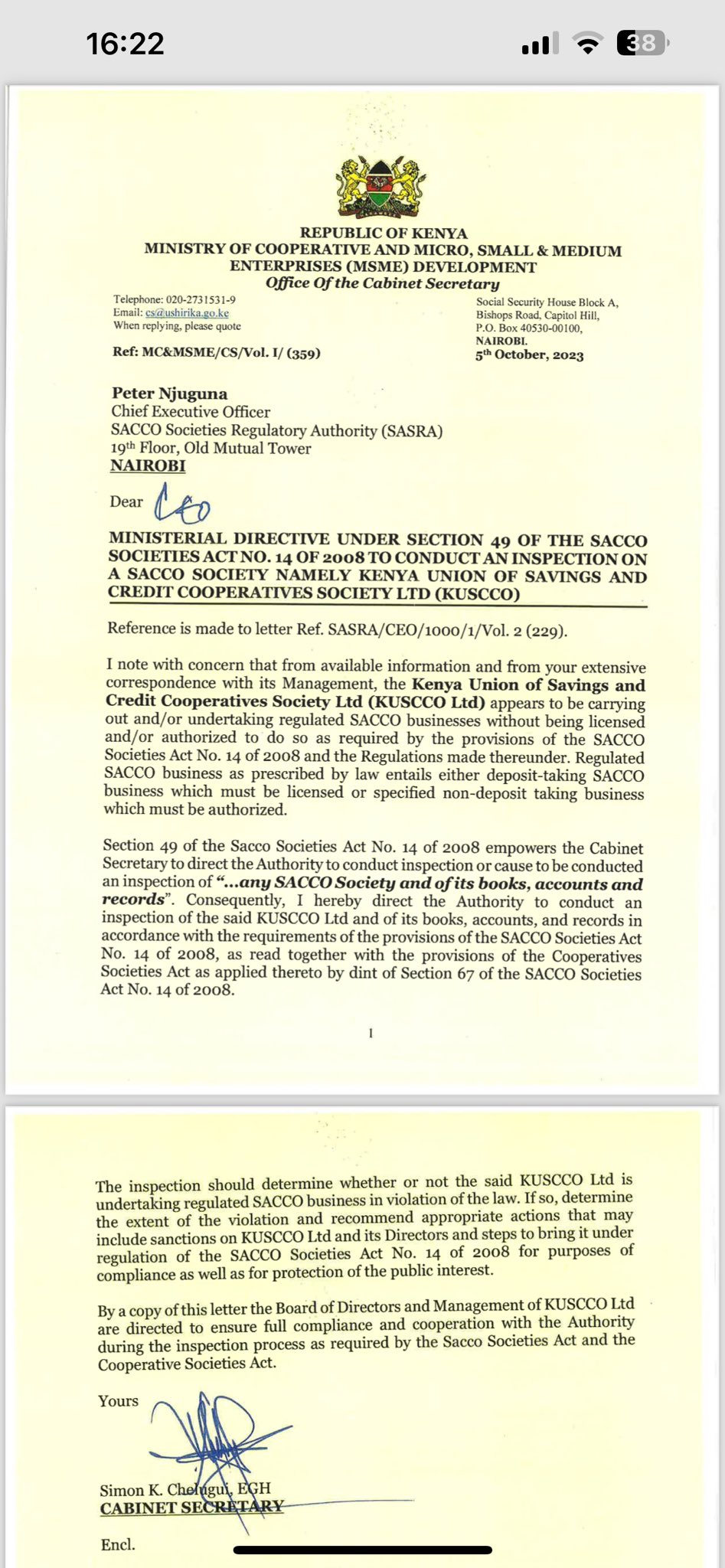

The CS for Co-operatives and Micro, Small Medium Enterprises, Simon Chelugui, directed SASRA to conduct a thorough investigation and recommend appropriate actions, including sanctions on Kuscco and its directors. He has also urged the Sacco members to remain calm and cooperate with the auditors. Kuscco is the umbrella body of savings and credit cooperatives (Saccos) in Kenya, with over 4,000 affiliated Saccos and a membership of over 4 million.

It was registered in 1973 to advocate for a level environment in which Saccos can operate in. However, it appears that it has been carrying out regulated sacco business without being licensed or authorized by SASRA, in breach of the Sacco Societies Act No.14 of 2008. This has exposed the Sacco members to the risk of losing their hard-earned savings.

Serious investigations need to be done on the former KUSSCO Chairman, George Magutu. He’s the current chairman at New Fortis Sacco in Nyeri, the theft that is going on in that sacco is just bad news. His account at the sacco is allowed to Negate to whatever amount then one morning you wake up and the account has a positive balance!! The CEO at new fortis and George magutu the chairman will finish that teacher’s sacco hivi karibuni!!

Most KUSCCO board members are now saying they were not part of the fraud at the Sacco, and are shocked with the magnitude of the fraud at the sacco. Some planning to resign ahead of official investigative report that will be made public early January.

Investigators looking into Kuscco fraud have now verified that over Ksh 1.5 billion was lost, laundered through money from Kuscco to their Kitengela housing project. Many of the houses are incomplete and uninhabitable.

Investigators probing Kuscco fraud tell me former chairman George Magutu will be prosecuted over the Ksh. 10 Billion fraud at the Sacco despite leaving the giant in January when the official report will be made public.

Confussion as investigators come to the realization that Ksh. 1.6 Billion that was transferred from KUSCCO accounts to an illegally founded outfit called KUSCOO MUTUAL ASSURANCE never reached the accounts and only Ksh. 400 Million reached there. Ksh. 1.2 Billion vanished.

Those with their money at KUSCCO must be aware that only Ksh. 3.5 Billion is in their accounts. Almost Ksh. 10 Billion cannot be located. CEO George Ototo has been given a deadline to explain where the other money went.

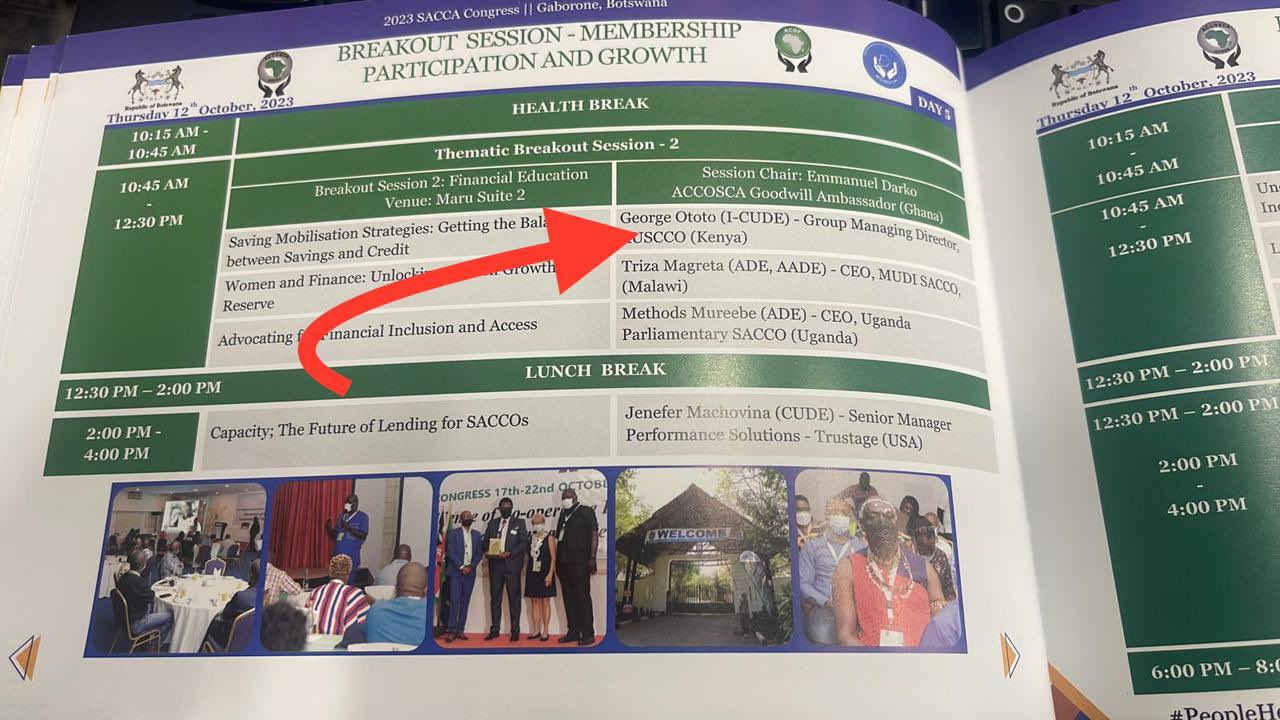

In October Ototo was chased away from Botswana Sacca conference where he was to present and told to take the next flight to Kenya to solve audit and fraud issues at Kusco. He should open his books for audit.

@SASRA_ke are just doing their work.

Why is he refusing to open his books for perusal. If he is clean, let him do so. He is dealing with Kenyans money and Regulation is a must.

KUSCCO Deposit-Taking Scandal: How CBK Exposed Multi-Billion Fraud

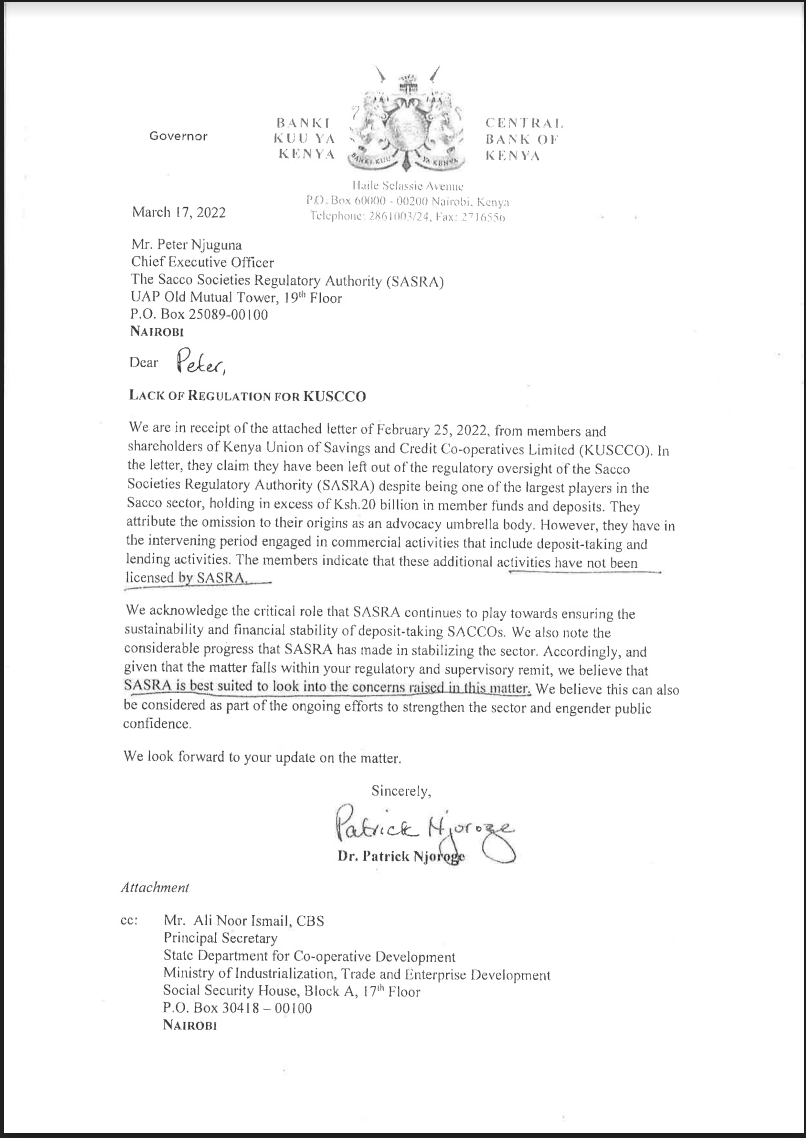

A concern raised by CBK regarding the regulation of KUSCCO’s deposit-taking business, following a complaint by a concerned SACCO leader, has initiated a multi-billion fraud investigation against KUSCCO.

On March 22, 2022, the former no-nonsense Governor of CBK, Dr. Patrick Njoroge, wrote to the SASRA CEO and the then PS Cooperatives, alerting them to the magnitude of the risk posed by KUSCCO’s continued deposit-taking business from regulated and unregulated SACCOs.

In the letter, Dr. Njoroge expressed concerns about how an entity holding close to Ksh 20 billion from SACCOs was not under the regulator’s purview. The Governor, known for his straightforward approach and emphasis on compliance in the financial sector, directed SASRA to conduct a review and establish the necessary regulatory framework for KUSCCO’s deposit-taking business.

Our sources report that the CEO of KUSCCO, Mr. George Ototo, vehemently opposed the regulation of KUSCCO’s deposit-taking despite the obvious risks. As a follow-up to Dr. Njoroge’s letter, the current administration, through the CS of Cooperatives and MSMEs, Mr. Simon Chelugui, directed SASRA to conduct an inspection of KUSCCO and report on whether the continued deposit-taking business is legal and if any offenses have been committed.

They were also instructed to apply the necessary mechanisms to regulate the business. After a one-month review, the preliminary findings of SASRA are both shocking and worrying for the sector.

There are glaring discrepancies between the deposits collected from SACCOs, the loans advanced, and the available funds. Our sources report that about Ksh 8 billion cannot be accounted for. Major SACCOs have deposits in KUSCCO, with some SACCOs having over Ksh 900 million placed in KUSCCO.

Investigations are ongoing, linking several SACCO leaders to have benefited from commissions and incentives for placing deposits in KUSCCO. This has caused panic in the sector, with several CEOs and boards siding with KUSCCO and opposing the investigations.

However, it is worth noting that the members’ funds are at risk if the forensic audit or investigations are not completed to establish the whereabouts of Ksh 8 billion. Once KUSCCO learned that the preliminary report incriminated some of their activities and actions, they rushed to court and obtained restraining orders against SASRA.

How this has been allowed to happen has puzzled everyone in the sector. The only available option now is for the Commissioner of Cooperatives to send an inquiry team to KUSSCO to unearth the decade-old malpractices at the institution. It is worth noting that Kenya has just been ranked ‘Poor’ by the World Bank & IMF on the Anti-money Laundering Framework and Policies.

The lack and failure of oversight of a key institution that has about Ksh 20 billion in deposits complicate Kenya’s efforts in regulating and enforcing compliance in the financial sectors. KUSCCO management has gone all out with massive campaigns and propaganda to tarnish the government’s efforts to strengthen the SACCO subsector.

The big question is: Are members’ hard-earned savings in their respective SACCOs safe? Amidst all this, KUSCCO has organized regional forums to discredit the ongoing inspection.

They have mobilized SACCO leaders to attend a forum in Mombasa in early December 2023 to continue with the incitement.

Who will save the sector from the imminent risk of massive loss of funds and fraud? Our sources have indicated that in the next few days, a detailed list of all the SACCOs that have placed huge deposits will be released to the public.

It is important to note that KUSCCO does not have funds to honor the maturing deposits and has, for a long time, been rolling over the funds with higher interests.

Currently, the DCI and the EACC have been invited to commence criminal investigations against the management team and other leaders who have been part of risking the members’ funds.

The days ahead may be turbulent for the embattled KUSCCO CEO and his management, but also painful decisions will have to be made to restore confidence in the SACCO subsector.